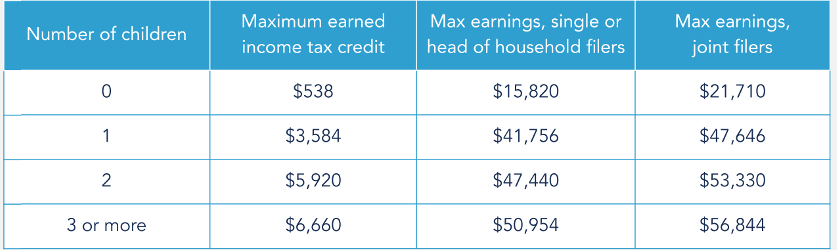

What would you do with extra cash for you and your family? The Earned Income Tax Credit (EITC) is a tax benefit for workers like you who make under a certain amount of money. Use the links and the chart below to check your eligibility. If eligible, set up a free appointment now to get back the money you earned!

Learn more about the Earned Income Tax Credit by watching the videos below:

You can only get EITC when you file a Federal tax return and claim it. You must have income earned from a job, cash

earned on your own, or from your business.

Find out by using the estimator below:

Maximum Income to Qualify for EITC

You, your spouse, and any qualifying child you list on your tax return must each have a Social Security number that is valid for employment.

You must file:

The Child Tax Credit (CTC) is a tax benefit to help parents, grandparents, siblings, foster parents, and others with the costs of raising children. If you meet a few qualifications and are raising a child, you might be able to receive the credit.

What’s new about the CTC in 2021?

As part of the 2021 American Rescue Plan, there are temporary changes and expansions to the Child Tax Credit (CTC). These changes include:

Do I qualify for CTC?

More Information & Resources:

If you qualify for EITC & CTC, set up a free appointment with our staff to receive the credit. To set up an appointment, contact Riham Ayoub, Public Health Coordinator, at 313-920-1662.